-

Loans, Taxes, and Law

What Is Hazard Insurance on a Mortgage?

If you’re purchasing a new home with a mortgage loan, your lender will likely require you to have hazard insurance, also known as homeowner’s insurance. But what exactly is hazard insurance, and why is it mandatory for securing a mortgage? What Is Considered Hazard Insurance for a Mortgage? Hazard insurance specifically refers to the dwelling coverage or property coverage portion…

Read More » -

Investing and Wealth Building

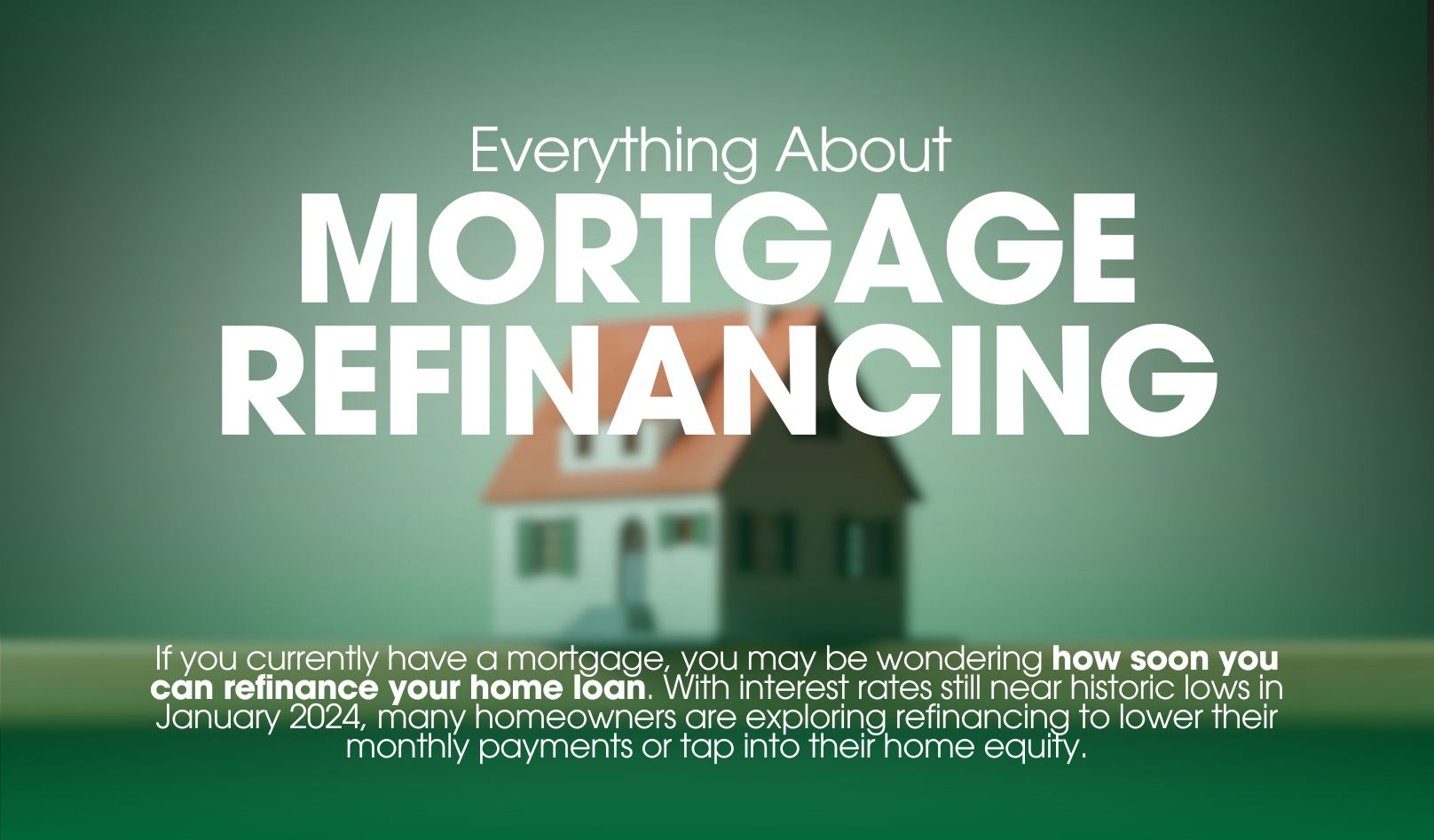

How Soon Can You Refinance a Mortgage? January 2024

If you currently have a mortgage, you may be wondering how soon you can refinance your home loan. With interest rates still near historic lows in January 2024, many homeowners are exploring refinancing to lower their monthly payments or tap into their home equity. But like purchasing a new home, refinancing comes with closing costs and underwriting requirements. So when…

Read More » -

Investing and Wealth Building

Pros and Cons of Reverse Mortgage: A Complete Guide

A reverse mortgage is a unique type of loan that allows homeowners aged 62 and older to tap into their home equity without having to make monthly payments. With a reverse mortgage, the lender pays you either a lump sum, regular payments, or a line of credit. You don’t have to repay the loan until you permanently move out, sell…

Read More » -

Investing and Wealth Building

Best Mortgage Lenders of January 2024

If you’re looking to buy a new home or refinance your current mortgage in 2024, it’s important to find the best mortgage lender for your specific needs. With hundreds of lenders to choose from, comparing options and finding the right fit can feel overwhelming. This comprehensive guide will walk you through the top mortgage lenders to consider this year based…

Read More » -

Loans, Taxes, and Law

What is a Reverse Mortgage and How Does it Work?

A reverse mortgage is a unique type of loan that allows homeowners aged 62 and older to convert part of the equity in their home into cash. With a reverse mortgage, you receive money from the lender while still retaining ownership of your home. Unlike a traditional mortgage, you don’t make monthly payments with a reverse mortgage. Instead, the lender…

Read More » -

Investing and Wealth Building

6 Different Types of Mortgage Lenders

When it comes time to get a mortgage, one of the first decisions you’ll need to make is choosing what type of mortgage lender you want to work with. There are several different types of lenders, each with their own pros and cons. Doing your research on the different types of mortgage lenders can help ensure you find the right…

Read More » -

Loans, Taxes, and Law

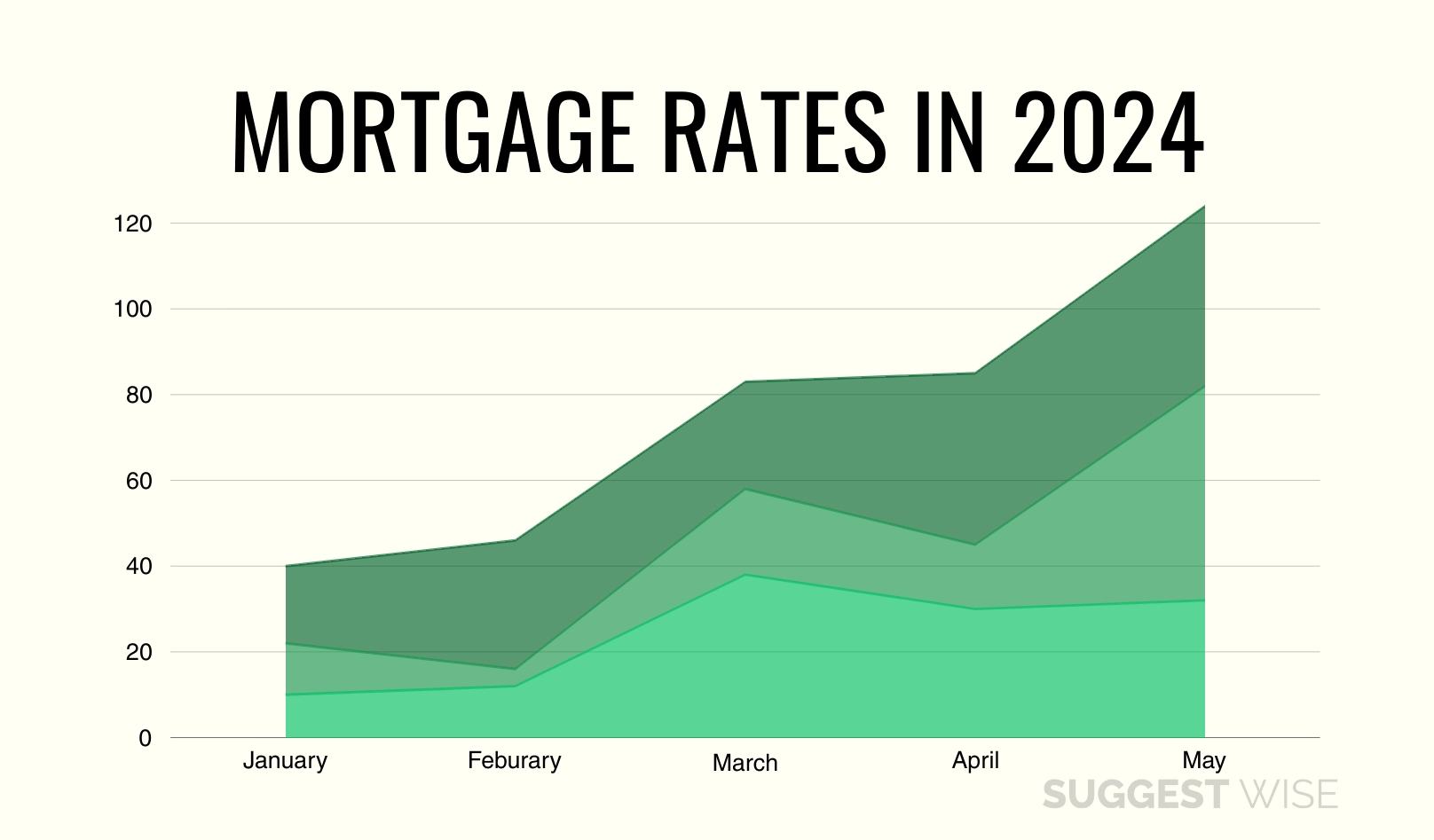

Mortgage Rates in January 2024

Mortgage Rates in January 2024 Mortgage rates in January 2024 remain elevated compared to historic norms but have edged down from the highs seen in late 2022. With inflation showing signs of cooling and the Federal Reserve pausing its aggressive rate hike campaign, expectations are for mortgage rates to continue moderating through 2024. However, volatility remains in the near-term forecast.…

Read More » -

Investing and Wealth Building

What Is a Mortgage? How it Works and Its Benefits

A mortgage is one of the most common ways for people to finance the purchase of a home. But what exactly is a mortgage, how does it work, and what are the benefits? This comprehensive guide provides all the key information you need to know. What is a Mortgage? A mortgage is simply a loan used to finance the purchase…

Read More » -

Investing and Wealth Building

Choice Home Warranty And George Foreman: Protect Your Dream

Purchasing a home is a major investment. Unforeseen system and appliance breakdowns can derail that dream. That’s why over 2 million homeowners trust Choice Home Warranty for protection, transparency and service excellence. With George Foreman’s endorsement, this home warranty provider delivers added reassurance. Introduction to Home Warranties A home warranty offers budget protection by covering repairs and replacements for home…

Read More » -

Investing and Wealth Building

How to Become a Mortgage Broker: Embarking on the Path

Introduction to Mortgage Brokerage A mortgage broker acts as an intermediary between borrowers and lenders to help clients obtain home loans. They provide guidance on loan options, qualify borrowers, prepare loan applications, and negotiate rates and fees. With the rise of online lenders and loan shopping portals, the role of mortgage brokers is more important than ever. The Rise of…

Read More »