-

Market Trends and Innovations

Biden Announces a Change in Student Loan Forgiveness Plan

The Biden administration recently announced a new student loan forgiveness initiative that will cancel remaining balances for certain federal student loan borrowers starting in February 2024. This new plan aims to provide relief for those struggling with student debt under the Saving on Valuable Education (SAVE) repayment program. Who Qualifies for Loan Forgiveness Under the New Initiative? Borrowers who originally…

Read More » -

Investing and Wealth Building

Best Mortgage Lenders of January 2024

If you’re looking to buy a new home or refinance your current mortgage in 2024, it’s important to find the best mortgage lender for your specific needs. With hundreds of lenders to choose from, comparing options and finding the right fit can feel overwhelming. This comprehensive guide will walk you through the top mortgage lenders to consider this year based…

Read More » -

Loans, Taxes, and Law

How to Get a Startup Business Loan With No Money

Starting a new business can be an exciting yet challenging experience. While you may have a great idea or product, one of the hardest parts is figuring out how to get funding when you don’t have existing revenue or assets to leverage. The good news is that there are still options for securing small business loans even if you have…

Read More » -

Personal Finance

Fixed Expenses vs. Variable Expenses: Key Differences

Understanding the difference between fixed and variable expenses is crucial for effective business budgeting and financial planning. Fixed expenses are costs that remain largely the same each month. Knowing what comprises your business’s fixed costs allows you to accurately forecast and budget for them. What Are Fixed Expenses? Fixed expenses are periodic business costs that don’t change dramatically from month…

Read More » -

Personal Finance

What is Liability Car Insurance Coverage (Cost 2024)

Liability car insurance is one of the most important forms of auto insurance. Nearly every state requires drivers to carry liability coverage, yet many motorists don’t fully understand what it is or why it’s required. This article will explain what liability car insurance is, what it covers, how much it costs, and why it’s so crucial for drivers to have.…

Read More » -

Investing and Wealth Building

Top 7 High Yield Savings Accounts of 2024

A high yield savings account is one of the best places to keep your money if you want to earn a competitive interest rate with little risk. High yield savings accounts offer much higher annual percentage yields (APYs) than traditional savings accounts, allowing your money to grow faster. In 2024, the best high yield savings accounts are offering APYs around…

Read More » -

Loans, Taxes, and Law

What is a Reverse Mortgage and How Does it Work?

A reverse mortgage is a unique type of loan that allows homeowners aged 62 and older to convert part of the equity in their home into cash. With a reverse mortgage, you receive money from the lender while still retaining ownership of your home. Unlike a traditional mortgage, you don’t make monthly payments with a reverse mortgage. Instead, the lender…

Read More » -

Loans, Taxes, and Law

How to Get a Personal Loan with Bad Credit – Complete Guide

Having a poor credit score can make getting approved for a personal loan more challenging. However, there are still options available even if you have bad credit, which offer guaranteed approval loans. Here is a complete guide on how to get a personal loan with bad credit. 1. Check Your Credit Score and Reports The first step is to check…

Read More » -

Investing and Wealth Building

6 Different Types of Mortgage Lenders

When it comes time to get a mortgage, one of the first decisions you’ll need to make is choosing what type of mortgage lender you want to work with. There are several different types of lenders, each with their own pros and cons. Doing your research on the different types of mortgage lenders can help ensure you find the right…

Read More » -

Loans, Taxes, and Law

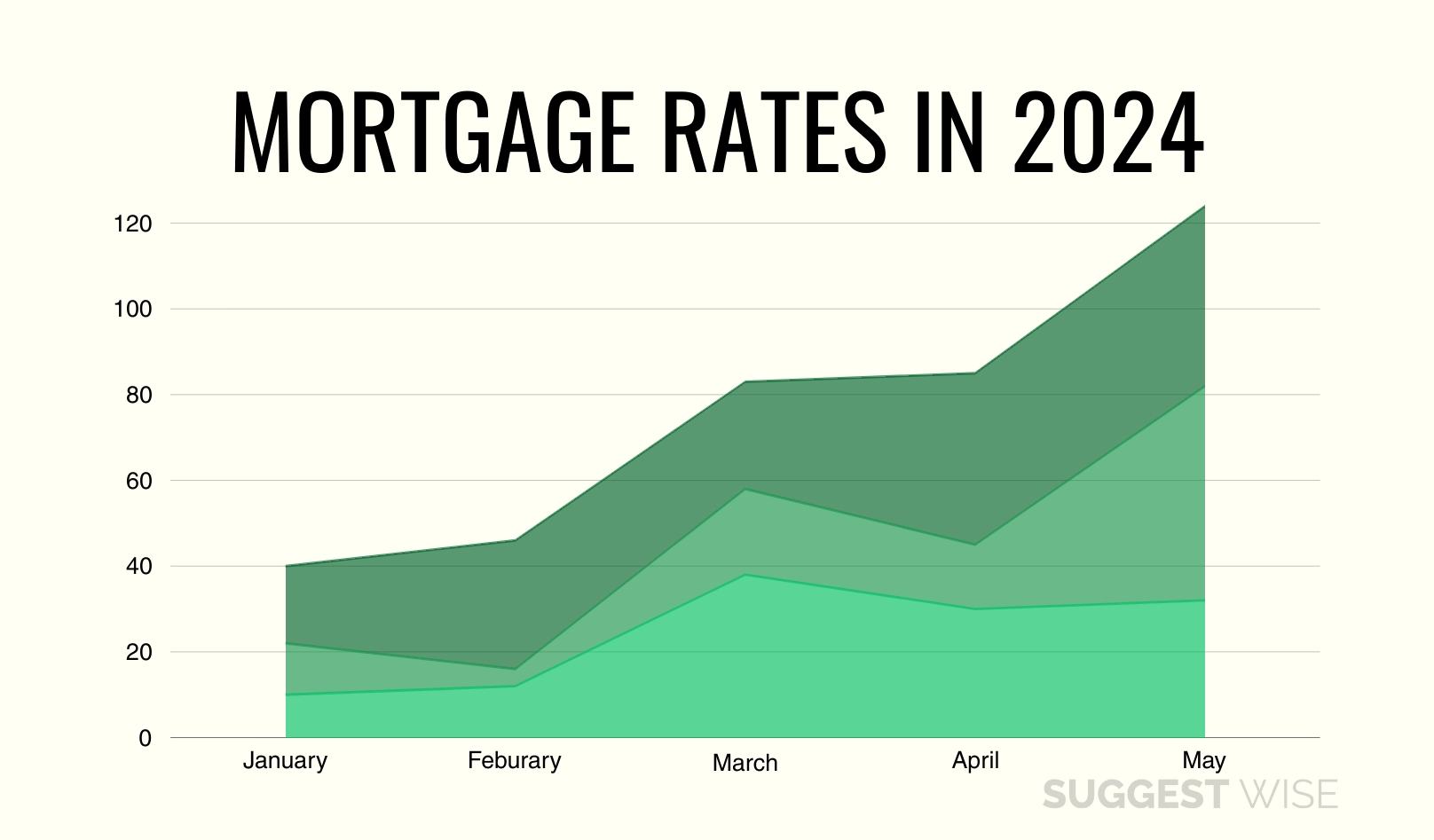

Mortgage Rates in January 2024

Mortgage Rates in January 2024 Mortgage rates in January 2024 remain elevated compared to historic norms but have edged down from the highs seen in late 2022. With inflation showing signs of cooling and the Federal Reserve pausing its aggressive rate hike campaign, expectations are for mortgage rates to continue moderating through 2024. However, volatility remains in the near-term forecast.…

Read More »