-

Investing and Wealth Building

Start Making Money by Investing in Stocks: A Beginner’s Guide

Investing in stocks can be a great way to grow your money over time. However, it does require some knowledge and planning to be successful. This beginner’s guide will walk you through the basics of stock market investing, so you can start putting your money to work. How Does Investing in Stocks Work? When you purchase shares of a company’s…

Read More » -

Personal Finance

How Does a Money Market Account Work? A Complete Guide

A money market account is a type of savings account that offers benefits like limited check writing and debit card privileges. Money market accounts work differently than traditional savings accounts and provide some unique features. This comprehensive guide will explain what a money market account is, how it works, its key features, pros and cons, and help you determine if…

Read More » -

Personal Finance

How to Get Health Insurance Without a Job: Complete Information

Losing your job can be stressful enough without having to worry about health insurance. Fortunately, you have several options to get affordable health coverage even if you are unemployed. This guide will walk you through the main ways to get health insurance without a job, factors to consider when choosing a plan, and tips for saving money on healthcare costs…

Read More » -

Personal Finance

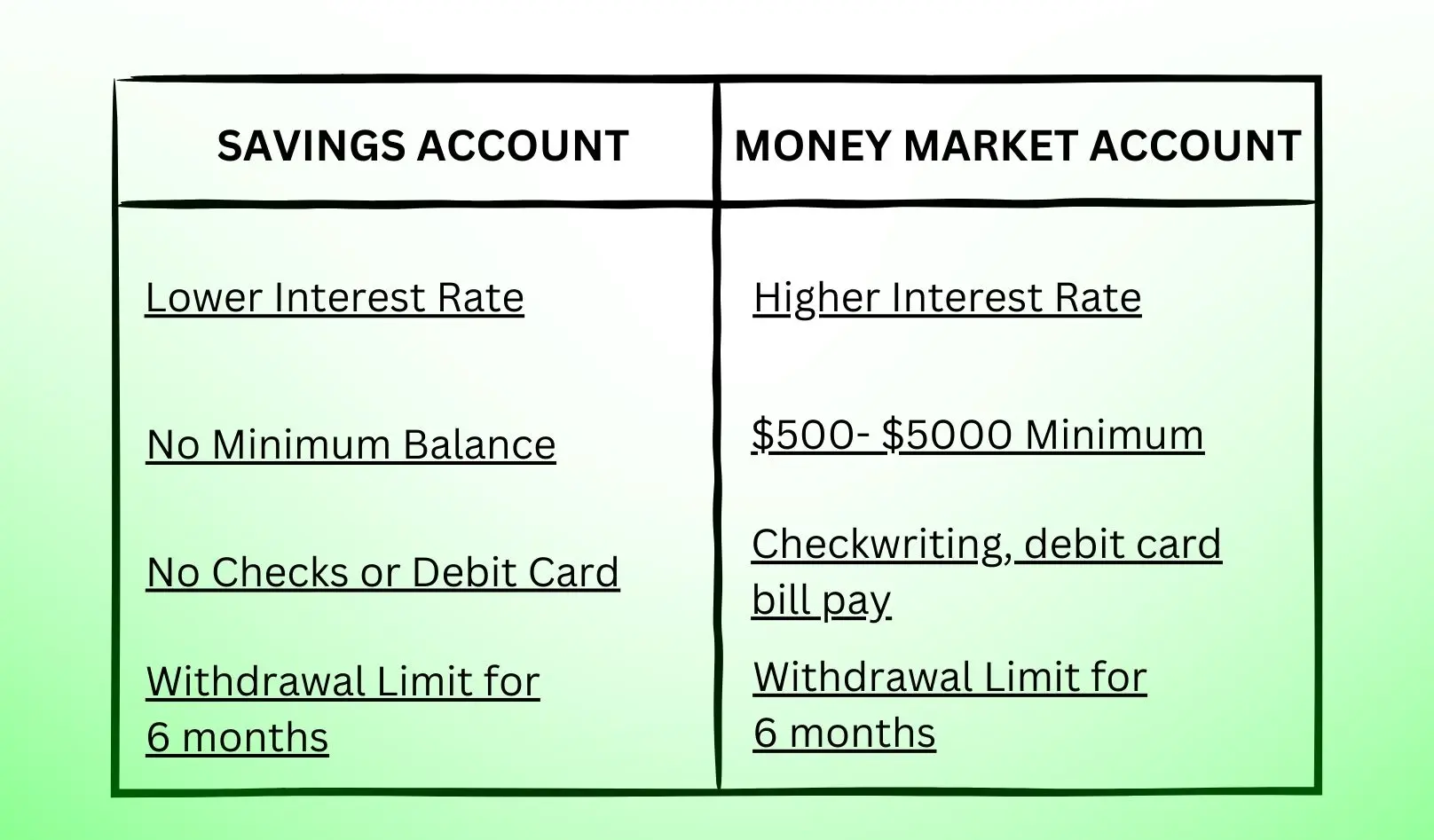

Savings Account 101: How does a Savings Account Work?

A savings account is one of the most basic and essential financial products that everyone should have. But how exactly does a savings account work? What are the benefits of having one? This comprehensive guide will explain everything you need to know about opening, using and maximizing a basic savings account for you to earn the most money. What is…

Read More » -

Loans, Taxes, and Law

What is Comprehensive Car Insurance Coverage?

Comprehensive insurance is an optional type of car insurance that covers damage to your vehicle from non-collision incidents. It goes beyond basic liability coverage to protect against theft, vandalism, weather events, fire, hitting animals, and more. If you’ve ever wondered “What is comprehensive insurance and should I get it?”, this guide will explain everything you need to know about this…

Read More » -

Investing and Wealth Building

Are High Yield Savings Accounts Safe to Invest?

A high yield savings account is considered one of the safest places to put your money. If you’re looking for a low-risk way to earn interest on your savings, a high yield account is a great option. But are these accounts really as safe as they seem? What is a High Yield Savings Account? A high yield savings account is…

Read More » -

Investing and Wealth Building

Money Market Account vs Savings Account: Select Wisely

When it comes to choosing between a money market account and a savings account, there are some key differences to consider. Both accounts can help you earn interest on your money, but they operate differently. This guide examines the pros and cons of each and provides tips on deciding which is best for your needs. What is a Money Market…

Read More » -

Personal Finance

What is Liability Car Insurance Coverage (Cost 2024)

Liability car insurance is one of the most important forms of auto insurance. Nearly every state requires drivers to carry liability coverage, yet many motorists don’t fully understand what it is or why it’s required. This article will explain what liability car insurance is, what it covers, how much it costs, and why it’s so crucial for drivers to have.…

Read More » -

Investing and Wealth Building

Top 7 High Yield Savings Accounts of 2024

A high yield savings account is one of the best places to keep your money if you want to earn a competitive interest rate with little risk. High yield savings accounts offer much higher annual percentage yields (APYs) than traditional savings accounts, allowing your money to grow faster. In 2024, the best high yield savings accounts are offering APYs around…

Read More » -

Personal Finance

Checking vs. Savings Account: How These are Different?

Opening a checking account and a savings account are integral steps in managing your money. But what exactly sets these two account types apart? While both provide relatively low-risk places to store your funds, checking and savings accounts have distinct characteristics. Understanding those key differences will ensure you choose the right accounts to meet your financial needs and financial goals.…

Read More »