When it comes to choosing between a money market account and a savings account, there are some key differences to consider. Both accounts can help you earn interest on your money, but they operate differently. This guide examines the pros and cons of each and provides tips on deciding which is best for your needs.

What is a Money Market Account?

A money market account is a type of savings account offered by banks and credit unions. Money market accounts provide a higher interest rate than regular savings accounts. They also come with some transactional features:

- Check writing – Most money market accounts allow you to write a limited number of checks per month, such as 3 or 6.

- Debit card – Many money market accounts provide a debit card for purchases and ATM access.

- Online bill pay – You can use money market account funds to pay bills online.

- Transfers – Money market accounts permit you to transfer funds electronically.

- Interest rates – Money market accounts earn higher variable interest rates than regular savings accounts. Rates may be tiered based on your balance.

- FDIC/NCUA insured – Balances up to $250,000 are insured at banks and credit unions.

- Withdrawal limits – While rules have relaxed, withdrawals may still be limited to 6 per month by federal regulation.

What is a Savings Account?

A traditional savings account allows you to deposit money and earn a modest interest rate. Savings accounts are more limited transactionally than money market accounts:

- Interest – Savings accounts earn lower variable interest rates than money market accounts.

- No checks – You cannot write checks from a standard savings account.

- No debit card – Savings accounts do not come with debit cards for purchases. You may get an ATM card.

- Limited withdrawals – Like money markets, savings accounts restrict withdrawals to 6 per month by federal regulation.

- FDIC/NCUA insured – Again, you have up to $250,000 of deposit insurance.

- Low minimums – Savings accounts tend to have low or no minimum balance requirements.

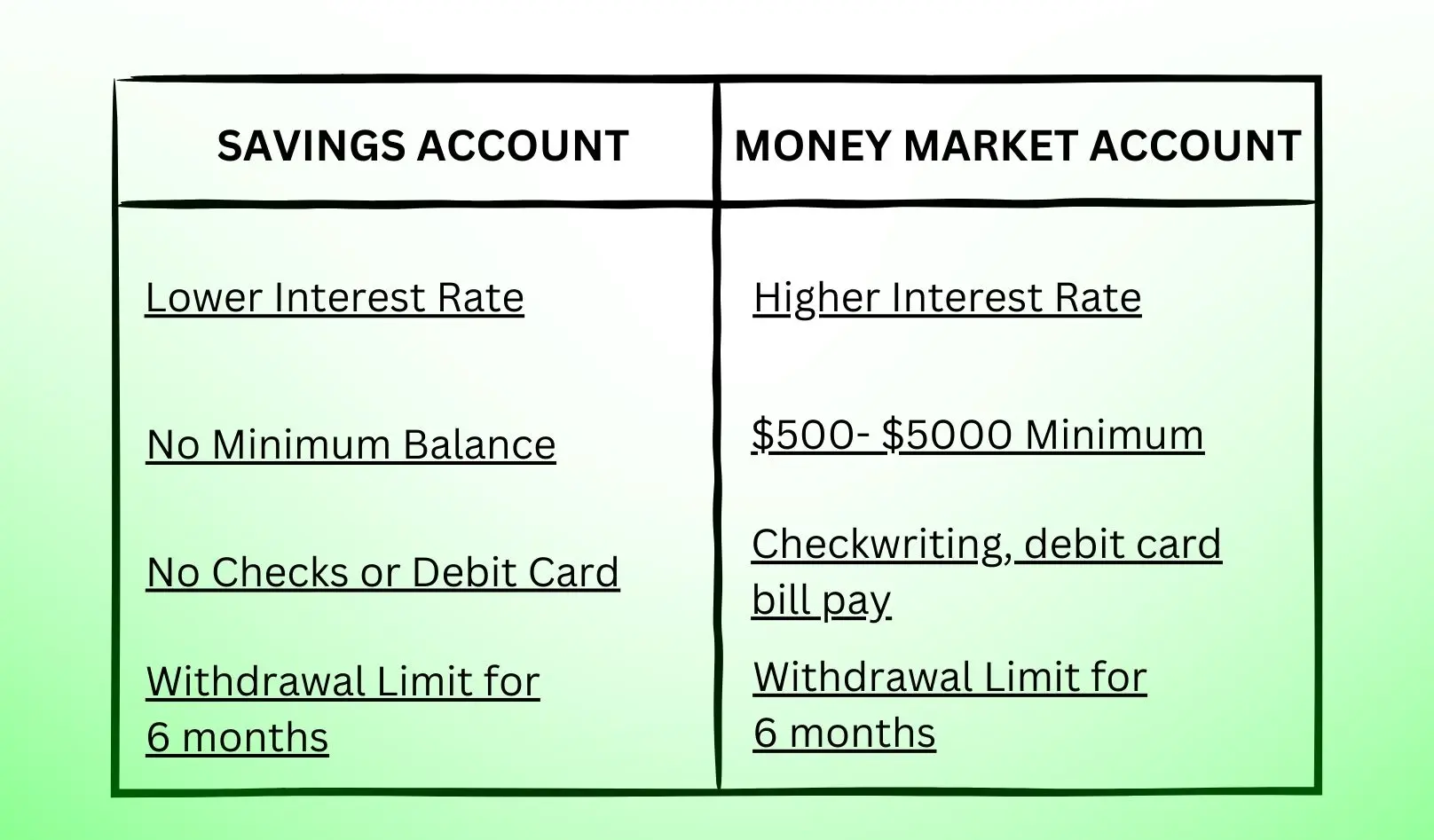

Money Market vs Savings Account Comparison

Feature | Money Market Account | Savings Account |

| Interest Rate | Higher | Lower |

| Minimum Balance | Often $500-$5000 | Usually none or low minimum |

| Transaction Features | Checkwriting, debit card, bill pay | No checks or debit card |

| Withdrawal Limits | Up to 6/month | Up to 6/month |

| FDIC/NCUA Insured | Up to $250,000 | Up to $250,000 |

When to Choose a Money Market Account

A money market account offers the convenience of writing checks and using a debit card while earning interest. Here are some reasons why a money market account may be the better choice:

- You want to earn higher interest rates with the ability to transact.

- You need to write the occasional check to pay a bill.

- You want the flexibility of a debit card for purchases.

- You maintain larger deposit balances to earn higher interest tiers.

- You meet the minimum balance requirements, often $500-$5000.

When to Choose a Savings Account

For basic savings needs, a traditional or high-yield savings account gets the job done. Here are some scenarios where a savings account may be preferable:

- You want to build savings without check/debit access.

- You have a lower amount to deposit and save.

- You don’t need check writing capabilities.

- You only need to withdraw money occasionally.

- You want to open an account with little or no money.

Tips for Choosing the Right Account

When deciding between these two savings vehicles, keep these tips in mind:

- Compare interest rates – Shop around for the best yields on each account type. You may find money market and savings APYs are comparable.

- Review access needs – If you need to write checks or use a debit card, a money market account provides more convenience.

- Check minimum balances – Money market accounts often require higher opening and ongoing balances.

- Consider your goals – Are you saving for an emergency fund? Down payment? Or just putting aside spare cash? Your needs can help determine the right account.

- Watch for fees – Both account types may charge monthly maintenance fees if your balance falls below a threshold. Avoid this with sufficient funds.

- Check withdrawal limits – While rules have relaxed, many banks still limit both account types to 6 withdrawals per month. Understand the policies.

The Bottom Line

When weighing a money market account vs a savings account, look at your financial needs and account features. If you want higher yields with checkwriting, a money market account may be your best bet. But if you just need simple savings, a traditional or high-yield savings account gets the job done. Choose the account that aligns with your goals, balances, and desired access.

Frequently Asked Questions

Are money market and savings accounts safe?

Both account types are generally safe places to deposit money. Federal insurance through the FDIC (for banks) or NCUA (for credit unions) protects balances up to $250,000 per depositor in case of institution failure.

Which account usually has the higher interest rate?

Money market accounts tend to have slightly higher interest rates on average compared to savings accounts. However, online banks are increasingly offering high-yield savings accounts with rates comparable to some money market accounts.

Can I have both a money market account and a savings account?

Yes, you can open both a money market account and a traditional or high-yield savings account. The two account types can complement each other nicely.

What are the alternatives to money market and savings accounts?

If you don’t need regular access to your funds, certificates of deposit (CDs) can earn higher rates for locking up your money for a set period of time. Money market mutual funds are another option, but they are investment accounts rather than FDIC insured bank accounts.

Are withdrawals really limited to 6 per month?

While a federal regulation used to mandate the 6 withdrawal limit, the Federal Reserve Board scrapped this rule in 2020. However, many banks still impose caps as part of their account terms. Check your bank’s policies carefully before exceeding any withdrawal restrictions.