Many Americans understand the importance of savings, their approach often lacks the strategic approach that can make them the most money. According to the Consumer Federation of America report “Traditional Savings Accounts: Are They Still Popular?” 52.1% of all US household still resorts to traditional savings accounts, which typically offer low-interest rates. It’s time to change that now!

Moreover, a considerable portion of Americans aren’t fully aware of the leverage of the features of savings accounts and their limitations. It’s time to change that!

In this article, we will provide you with a complete guide on which savings account will earn you the most money by comparing the popular choices.

What is a Savings Account?

At its core, a savings account is great a financial tool for those who want to set aside a specific amount of their money while earning interest on it over time. With a savings account on your side, you get a secure and reliable repository for your funds which are easily accessible whenever you are in need of it. It’s the foundation of financial security and a responsible financial management tool for individuals and families.

Core Factors That Maximize Earning On Savings Accounts

There are two major factors that contribute to maximizing earnings on your savings accounts; Interest Rate and Compound Interest. However, you will also need to be knowledgeable about the features and restrictions that a savings account sets for the users. Here’s a deep dive into these factors.

Interest Rates

Interest rates are vital to any savings account as they increase your money to a certain percentage over time. The interest rate that a bank offers will determine how much your funds will grow over time, primarily on a yearly basis. If a bank is offering a higher interest rate means more money is earned, it’s as simple as that. However, the interest rates on savings accounts can vary widely, and the difference between these rates will have an impact on your earnings eventually.

Role of Compound Interest

You can say that compound interest is the secret sauce that significantly boosts your savings over time. It’s the idea of earning interest on both the amount that you have initially deposited and the compound interest. The science behind this interest is that the more frequently the interest is compounded, the more earnings will be generated. So, when you are choosing a savings account, keep in mind how often you can compound interest as well as the normal interest rate that you get.

Various Savings Account Features and Restrictions

Like conventional accounts, savings accounts also come with few beneficiary features, which you should know at all costs. If the savings account you choose for yourself doesn’t include mobile banking, that is a must for you, making this choice will be a mistake. The common account accessibility features include; digital banking and mobile banking. Moreover, you get the luxury of creating sub-savings accounts as well, which can be used for your kids.

Comparing Different Saving Accounts

There are three prominent savings accounts that will earn you the most money. Note that we will not talk about standard saving accounts as their interest rates aren’t that high compared to these three. Go through these three and you will know which savings account will earn you the most money.

A thing to keep in mind is that the way we listed these savings accounts states the overall position of that account as well. This means the first one on the list is the best, and the others will be listed accordingly.

1. Certificate of Deposit (CD)

Certificate of deposit (CD) are time-bound savings accounts proposed by many banks in the US. They usually offer interest rates higher than those of traditional savings accounts as well as Money Market Accounts. However, you must agree to keep your funds closed in the account for a specific period as per the terms and conditions. Because early withdrawals can result in penalties, that can be equivalent to several months’ worth of interest.

Locking in Returns: A Deeper Look

Pros:

- Fixed, high interest rates.

- Returns are guaranteed.

- FDIC insured.

Cons:

- Funds cannot be added during the CD’s term.

- Funds are not easily accessible.

- Early withdrawal penalties.

Top CDs Accounts for Earnings

- Western Alliance Bank: 12-Month High-Yield CD – 5.51% APY

- SkyOne Federal Credit Union: 5-Month High-Yield CD – 5.40% APY

- mph.bank: 10-Month High-Yield CD – 5.30% APY

- Lemmata Savings Bank: 9-Month High-Yield CD – 5.20% APY

- CIT Bank Term CD: Up to 5.00% APY

2. Money Market Accounts

The second and another great option for many is the Money Market Accounts as they combine features of both savings and checking accounts. In some aspects, they are as valuable as CD as they offer better interest rates than both conventional and High-Yield saving accounts. What’s great about these accounts is that they are versatile and often come with an ATM card or debit card so you can get convenient access to your money.

The Versatile Option: Pros and Cons

Pros:

- High APY.

- FDIC insured.

- Funds can be more accessible.

Cons:

- Interest rates can fluctuate.

- Typically requires an opening deposit or maintaining a certain balance.

- Limited to six withdrawals per month.

Top Money Market Accounts for Earnings

- American First Credit Union: Money Market Deposit Account – 5.27% APY

- Pacific Western Bank: Money Market Deposit Account – 5.27% APY

- SkyOne Federal Credit Union: Money Market Deposit Account – 5.24% APY

- Patriot Bank: Money Market Account – 5.22% APY

- Ponce Bank: Money Market Deposit Account – 5.15% APY

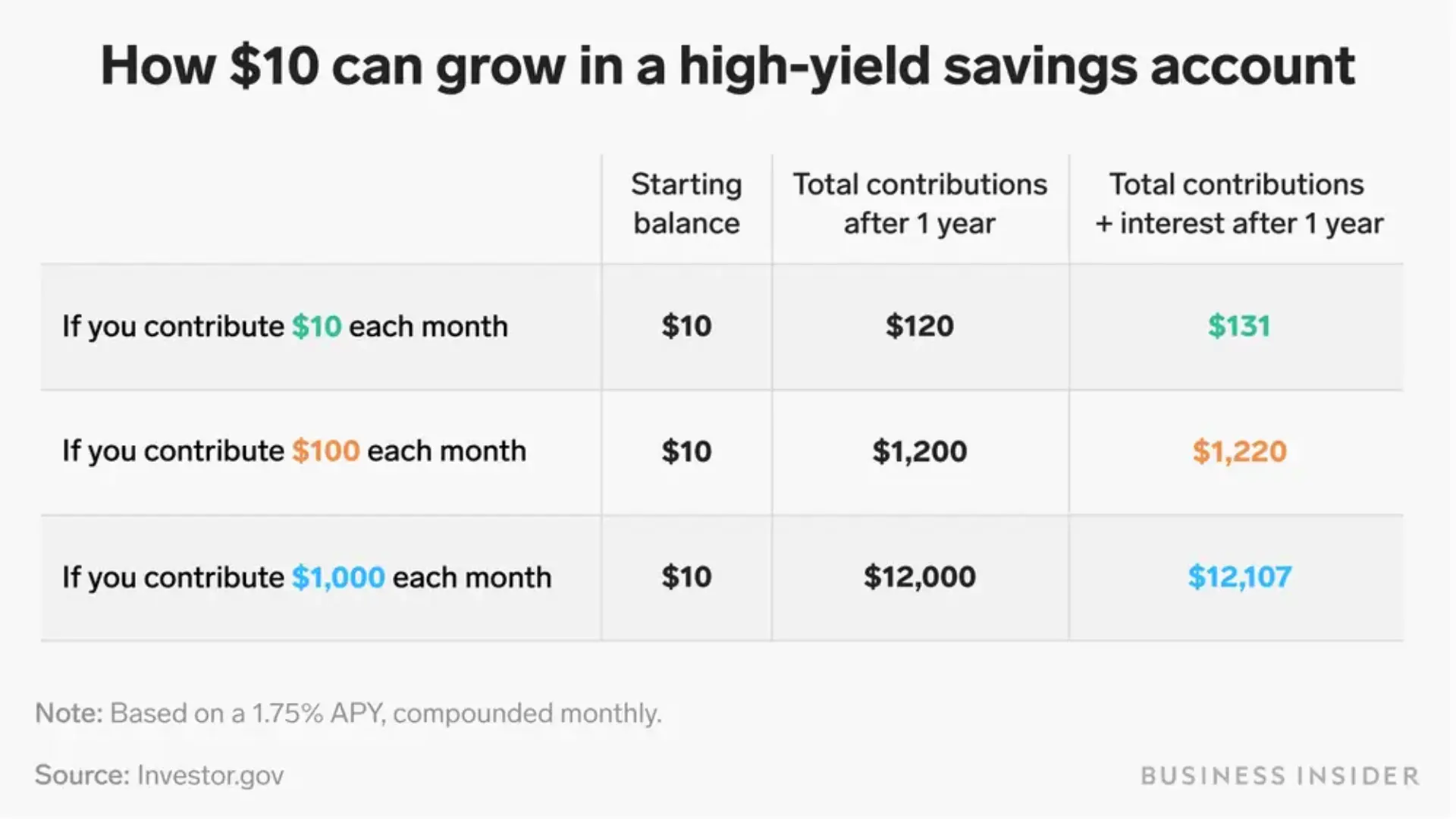

3. High-Yield Savings Accounts

High-yield savings accounts are more like traditional savings accounts. However, they offer much higher interest rates than those standard accounts, often five times more than the national average, making them a great alternative. These types of savings accounts are commonly presented by online banks, which means that they will have fewer physical locations and fewer ATMs. However, with their low charges, they become an attractive option.

Pros and Cons: Understanding Their Potential

Pros:

- High Annual Percentage Yield (APY).

- FDIC-insured.

- Often no fees, initial deposit, or balance requirement.

Cons:

- Interest rates may fluctuate.

- Typically limited to six withdrawals per month.

- Usually, no ATM card.

Top High-Yield Savings Accounts For Earning

- Cloudbank 24/7: High Yield Savings Account – 5.26% APY

- GreenState Credit Union: High-Yield Savings Account – 5.16% APY

- CIT Bank Platinum Savings: 5.05% APY

- Quontic: High Yield Savings – 4.50% APY

Which Savings Account Will Earn You the Most Money?

CD (Certificate of Deposit) accounts earn higher interest rates than conventional savings accounts as well as Money Market Accounts and High-Yield Savings Accounts. However, CDs don’t allow easy accessibility and also have withdrawal penalties. So, if you want to have the luxury of accessibility, the other two choices will be your best bet.

Ineligible Entities Who Can’t Open a Savings Account

Ineligible entities here refer to the specific types of individuals or organizations that do not meet the eligibility criteria or face challenges in creating a savings account. These challenges may be due to regulatory restrictions, procedures set by financial institutions, or distinct requirements that these entities cannot fulfill at any cost. Here are some of the ineligible entities:

- Non-U.S. Residents: Most of the individuals who fall into the category of ineligible entities are non-U.S. residents. This is because every bank and credit union in the United States requires the account holders to have a legal U.S. residency status.

- Individuals Under the Age of 18: Minors, generally those who are under the age of 18, are not eligible to open a savings account by themselves. Because the majority of the banks set terms that the account holders should be at least 18 years old to open a savings account independently.

- Certain Types of Organizations: There are a few financial institutions in the country that have policies that restrict specific types of organizations from opening a savings account. Some examples where these institutions set limitations include; non-profit organizations, clubs, etc.

- Regulatory Restrictions: In some circumstances, regulatory provisions set by government authorities or financial industry regulations impose restrictions. These distinguish entities who can access savings accounts and who cannot. Because they are there to prevent unlawful or unauthorized use of financial services.

Addressing User Concerns

While the savings accounts we have mentioned do have the potential to make you the most money, there are a few things that should concern you. If you are an individual who has been using a savings account for a while now, you must have these already, and if you are just starting out your journey, here’s what you should know:

How to Ensure That Your Savings Are Secure?

Some individuals have a tendency to know how safe their money is and for that purpose, FDIC (Federal Deposit Insurance Corporation) comes to play its part. Safety is a major concern when it comes to saving money for individuals and groups alike, and it should concern you. Fortunately, FDIC insurance protects your deposits up to $250,000 per individual account and $500,000 per co-owner on a joint account.

What’s even more amazing is that even in case your bank experiences financial trouble, your savings won’t be lost. So, make sure that your chosen financial institution is FDIC-insured or else your savings won’t be secure.

What Are The Potential Costs Of a Saving Account?

You should know that every savings account will come with various fees and a few penalties as well. Understanding these potential costs really matters as you will know what’s coming and will be better prepared for it. Some of these common charges include monthly fees, excessive transaction fees, overdraft fees, and out-of-network ATM fees. While they are not any different from any conventional account, some accounts do charge early withdrawal penalties like CD (Certificate of Deposit).

Accessibility and Liquidity of a Savings Account

A major mistake that majority of the people make is choosing one of these factors, accessibility, and liquidity, and not even knowing what it holds. You should specify whether you need to maximize returns, more access to your funds, or both. Once you decide that you should choose the best suited. For example, Certificate of Deposits (CD) would be great for those who are looking to maximize returns however, you won’t have much access to your funds. Also, you will face a penalty if you withdraw before the given time.

What the Future Holds

There’s a lot to be expected as the future holds great value and you should be aware of it by keeping yourself updated. For instance, there’s Fintech (Financial Technology) that keeps getting better and better with a lot of innovations that are really changing the landscape. To sum it up, these are two things that hold great value and you should always be aware of:

Economic Trends

Always keep in mind that savings account returns no matter if they are CDs or High-Yield, can be influenced by economic trends. Also, during economic downfalls, the interest rates may decrease as well. This will affect the growth of your savings (AYP). So, keep an eye out all the time and keep yourself updated so that you can counter any issue that may come in the near future.

Fintech Innovations

Financial technology (fintech) innovations are now better than ever, making it fortunate for the user to get access to innovative solutions to make saving convenient. They are rapidly changing the savings landscape and are expected to keep on going at a greater pace. A great example of Fintech Solutions is the digital banks and apps that are offering innovative savings solutions with competitive rates. So, if are missing out on this, make sure to equip yourself with smart Fintech technology.

Ending Note

Here you have it, now you can decide for yourself which savings account will earn you the most money. You can choose Certificate of Deposit (CDs) to maximize your earnings as the interest rate is comparatively higher than other options. However, considering its limitations, you go for Money Market Accounts or High-Yield savings accounts. We’ll leave you with that, it’s up to you to decide.

Related Information

▶ Which Savings Account Will Earn You The Least Money?