-

Market Trends and Innovations

Biden Administration Proposes Strict Limits on Overdraft Fees to Provide Relief

The Biden administration made a major regulatory move this week that could save American consumers billions in overdraft fees charged by the nation’s largest banks. The proposed rules from the Consumer Financial Protection Bureau (CFPB) aim to rein in what the administration calls “junk fees” that disproportionately impact lower income households. Overdraft Fees Targeted in New Regulations Overdraft fees are…

Read More » -

Investing and Wealth Building

How Soon Can You Refinance a Mortgage? January 2024

If you currently have a mortgage, you may be wondering how soon you can refinance your home loan. With interest rates still near historic lows in January 2024, many homeowners are exploring refinancing to lower their monthly payments or tap into their home equity. But like purchasing a new home, refinancing comes with closing costs and underwriting requirements. So when…

Read More » -

Personal Finance

What are Fixed Expenses and How to Calculate Them?

Fixed expenses are costs that remain the same each month for a business, regardless of sales or production levels. Understanding fixed and flexible costs is critical for businesses to properly budget, set prices, and analyze profitability. This comprehensive guide examines what qualifies as a fixed expense, why calculating them matters, and how to accurately track fixed costs for your company.…

Read More » -

Market Trends and Innovations

Child Tax Credit Increase: What You Need to Know for 2024

The child tax credit (CTC) helps working families by reducing their federal income tax. Congress is considering expanding the CTC in 2024, which could provide more financial relief to millions of households. This article explains what the proposed child tax credit increase entails and who stands to benefit most. How Might the Child Tax Credit Increase in 2024? Currently, the…

Read More » -

Loans, Taxes, and Law

What are Payday Loans and How do they Work?

Payday loans are a type of short-term, high-interest loan that borrowers can access quickly. Also known as cash advance or check loans, payday loans allow people to borrow a small amount of money until their next paycheck. Then, the full loan amount plus fees must be paid back in a lump sum. Payday loans target borrowers who need fast cash…

Read More » -

Investing and Wealth Building

Are High Yield Savings Accounts Safe to Invest?

A high yield savings account is considered one of the safest places to put your money. If you’re looking for a low-risk way to earn interest on your savings, a high yield account is a great option. But are these accounts really as safe as they seem? What is a High Yield Savings Account? A high yield savings account is…

Read More » -

Market Trends and Innovations

Bull Market vs Bear Market: What’s the Difference?

Understanding the characteristics of a bull market versus a bear market is key for investors looking to make smart decisions. This guide examines the differences between bull and bear markets, including the unique dynamics of a crypto bull run, and strategies to navigate each type successfully. What is a Bull Market? A bull market refers to a prolonged period where…

Read More » -

Investing and Wealth Building

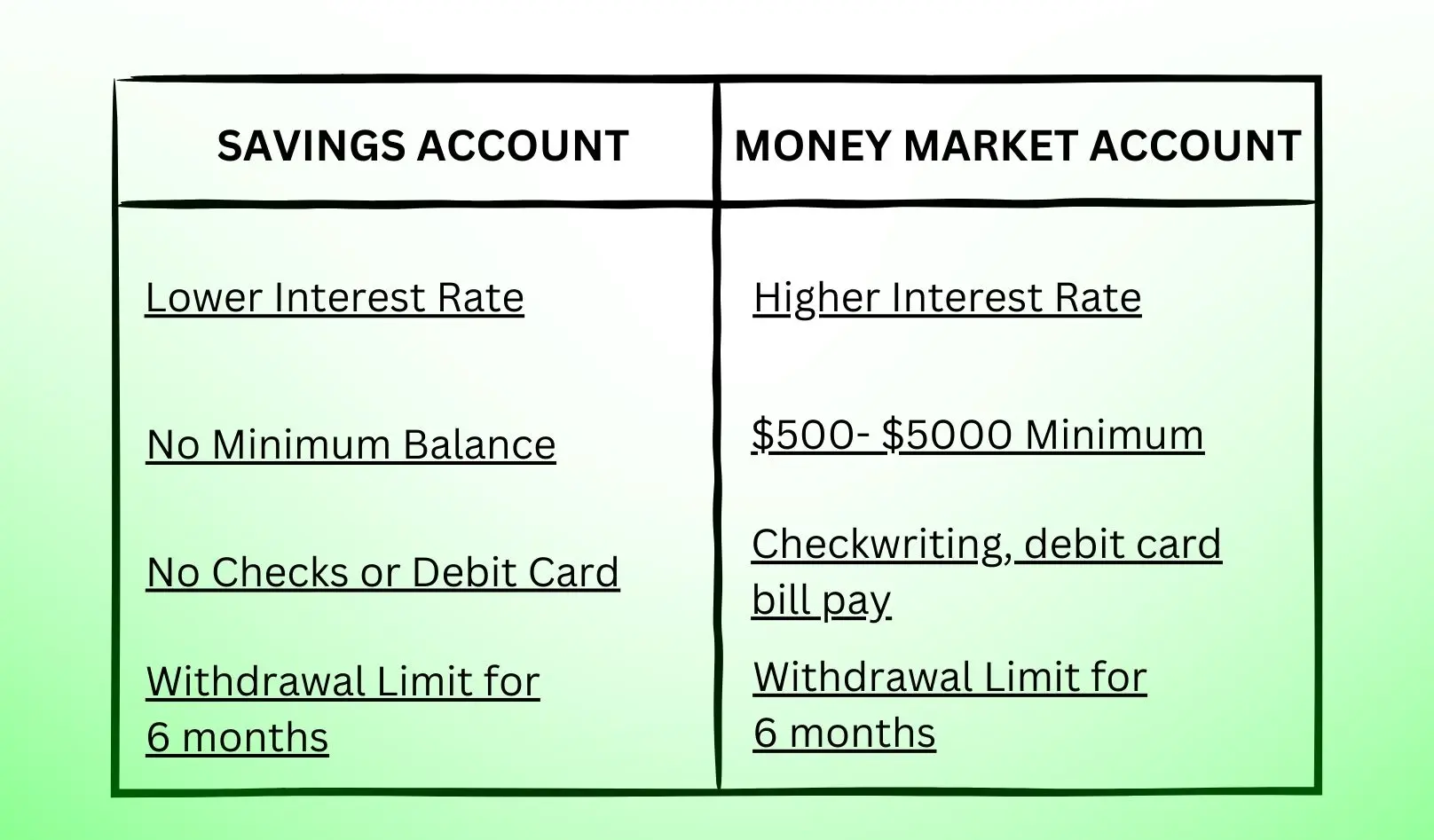

Money Market Account vs Savings Account: Select Wisely

When it comes to choosing between a money market account and a savings account, there are some key differences to consider. Both accounts can help you earn interest on your money, but they operate differently. This guide examines the pros and cons of each and provides tips on deciding which is best for your needs. What is a Money Market…

Read More » -

Investing and Wealth Building

Pros and Cons of Reverse Mortgage: A Complete Guide

A reverse mortgage is a unique type of loan that allows homeowners aged 62 and older to tap into their home equity without having to make monthly payments. With a reverse mortgage, the lender pays you either a lump sum, regular payments, or a line of credit. You don’t have to repay the loan until you permanently move out, sell…

Read More » -

Loans, Taxes, and Law

First Time Car Buyer Loan: Everything You Need to Know

Buying your first car is an exciting milestone, but getting approved for an auto loan can seem daunting if you have limited or no credit history. First time car buyer loans are designed to help in this situation. In this comprehensive guide, we’ll explain everything you need to know as a first time car buyer, from loan programs and requirements…

Read More »