Comprehensive insurance is an optional type of car insurance that covers damage to your vehicle from non-collision incidents. It goes beyond basic liability coverage to protect against theft, vandalism, weather events, fire, hitting animals, and more.

If you’ve ever wondered “What is comprehensive insurance and should I get it?”, this guide will explain everything you need to know about this important add-on policy.

What Does Comprehensive Insurance Cover?

Comprehensive coverage protects your vehicle when it’s damaged by something other than a collision. This includes:

- Theft

- Vandalism

- Weather events like hail, floods or hurricanes

- Fire

- Falling objects

- Collisions with animals like deer

- Explosions

- Riots or civil disturbances

Essentially, if your car is damaged while parked or not in an accident, comprehensive insurance will cover the repairs or replacement value if it’s totaled.

Comprehensive insurance also covers damage from projectiles like rocks kicking up from the road. And it covers glass damage, like if a tree branch falls and cracks your windshield.

Also Read: These States Need Insurance to Register a Car

Comprehensive Insurance Vs Collision Insurance

Collision and comprehensive insurance are often confused, but cover different things:

- Collision insurance covers repairs when your car collides with another vehicle or object. This includes single-car accidents like rollovers.

- Comprehensive covers non-collision damage from the incidents listed above.

Many insurers require you to carry both collision and comprehensive coverage together. They complement each other to fully protect your vehicle.

Is Comprehensive Car Insurance Required?

Comprehensive car insurance is not required by law, except in certain cases:

- If you have a lease or loan on your vehicle, the lender will likely require comprehensive and collision coverage. This protects their financial interest until you own the car outright.

- Some states require comprehension coverage for high-value specialty vehicles like classic cars.

So while optional for most drivers, comprehensive coverage is highly recommended for full protection. It covers risks that are difficult to avoid and often out of your control.

How Much Does Comprehensive Insurance Cost?

Comprehensive insurance premiums range between $100-$350 per year on average, depending on these factors:

- Your location – Rates vary by state risk factors.

- Deductible amount – The higher your deductible, the lower the premium.

- Vehicle make, model and age – Comprehensive costs more for newer cars.

- Your driving record – Good drivers pay less than high-risk drivers.

Compared to collision, comprehensive premiums are generally lower. But having both provides the best protection.

Comprehensive Car Insurance Deductible

Like other types of car insurance, comprehensive coverage comes with a deductible. This is the amount you pay out-of-pocket before the insurance covers the remaining cost.

Common deductible amounts are $500, $750, and $1,000. Higher deductibles bring lower premiums, but mean you pay more in the event of a claim.

Set your deductible based on what you can afford to pay if your car is damaged. For many drivers, a $500 or $750 deductible provides the best balance.

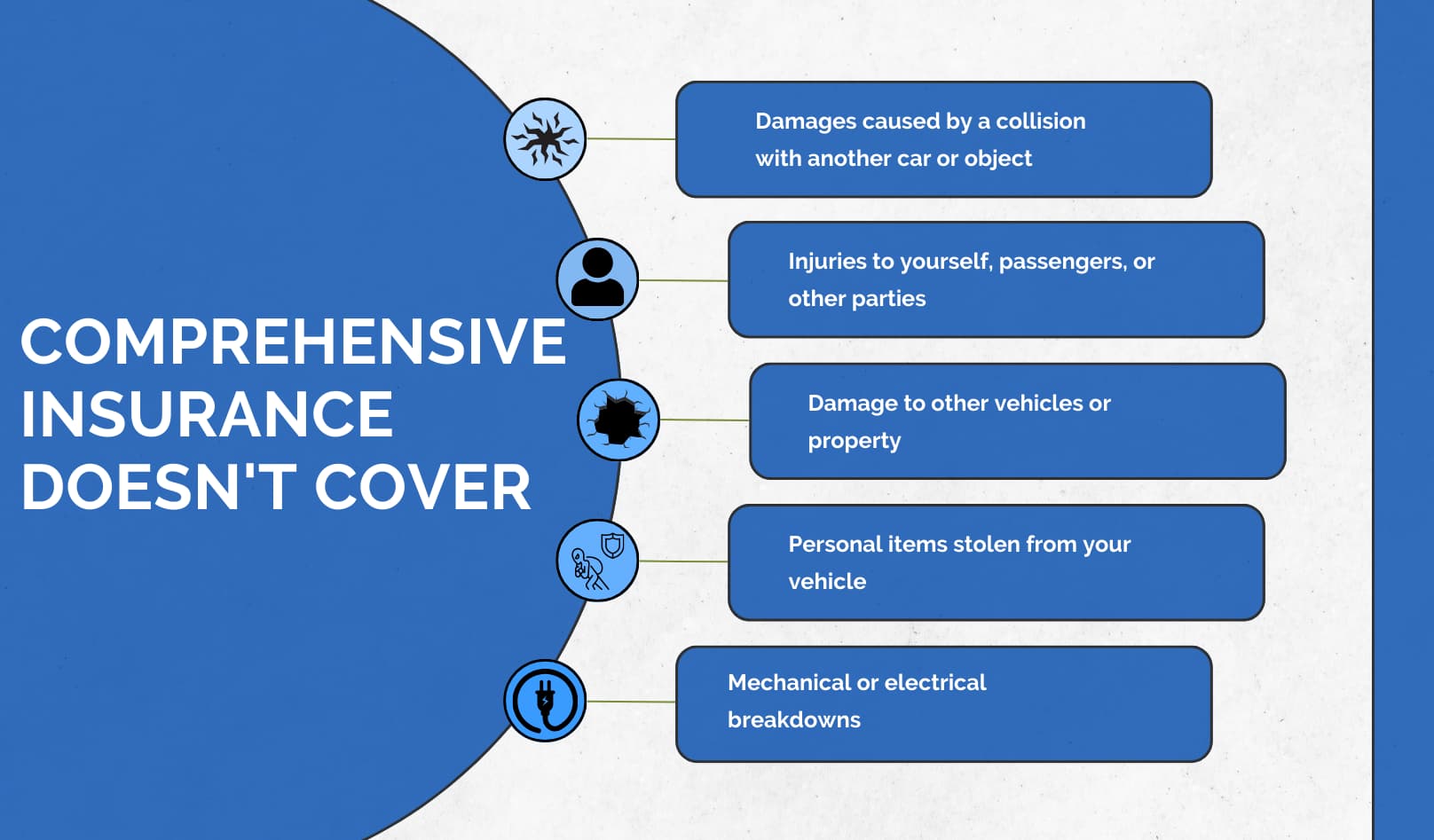

What Comprehensive Insurance Doesn’t Cover

While comprehensive coverage is extensive, it does not cover:

- Damages caused by a collision with another car or object

- Injuries to yourself, passengers, or other parties

- Damage to other vehicles or property

- Personal items stolen from your vehicle

- Mechanical or electrical breakdowns

These would be covered under liability, collision, or optional add-on policies. Comprehensive strictly covers direct damage to your own vehicle from non-collision events.

Is Comprehensive Insurance Worth It?

For most drivers, the extra protection of comprehensive insurance is well worth the cost. It covers risks that you have little control over and would be costly to pay for repairs or replacement out-of-pocket.

However, it may not be worth it if:

- You own an older vehicle with low cash value. The premiums may cost more than your car is worth.

- You can comfortably afford major repairs if damage occurred.

- You garage park your car in a secure location. This greatly reduces the risk of damage.

Unless you fall into one of those categories, comprehensive coverage is highly recommended to fully protect your investment.

How Does Comprehensive Insurance Work When You File a Claim?

Filing a comprehensive claim is straightforward:

- Take photos of the damage and call your insurance provider to start the claims process.

- An adjuster inspects your vehicle damage and writes up an estimate for repairs.

- You pay your deductible. Your insurer pays the repair shop directly for the remaining cost.

- Your vehicle is repaired and available to pick up once complete.

If your car is totaled, the insurer will pay you its actual cash value after deducting your comprehensive deductible.

The Bottom Line

Comprehensive car insurance provides important protection for your vehicle at an affordable cost for most drivers. It covers risks from weather, fire, theft, vandalism, animals, and more. While optional, it’s highly recommended unless you have an older low-value vehicle you can comfortably afford to repair or replace if damaged.

For optimal coverage, comprehensive insurance works hand-in-hand with liability and collision policies. Together, these cover all potential accident and non-accident vehicle damages. Compare quotes to find the best rates.

Comprehensive Car Insurance FAQ

What does comprehensive insurance cover that collision doesn’t?

Collision covers accident-related damages. Comprehensive covers non-accident damage like weather, fire, theft, vandalism, animals, and more.

Is comprehensive insurance required for a leased vehicle?

Most leasing companies do require you to carry comprehensive and collision coverage for a leased vehicle. This protects their asset until the lease ends.

What happens if I don’t have comprehensive and my car is totaled?

Without comprehensive insurance, you would have to pay all repair or replacement costs out-of-pocket if your car is damaged or totaled from a non-collision incident.

Does comprehensive cover hitting a deer?

Yes, collisions with deer or other animals are covered under comprehensive insurance. This includes damage from the impact as well as from running off the road.

Does comprehensive cover repairs from road hazards like potholes?

No, damage from road hazards falls under collision insurance. Comprehensive only covers non-collision related damages.

How much does comprehensive insurance cost per month?

Average costs run $12-$30 per month for comprehensive coverage, depending on your deductible, vehicle, and location. Bundling with other policies can further reduce the monthly payment.