Personal Finance

-

Innovative Personal Finance Projects for Students: A Comprehensive Guide

Personal finance education has become extremely important for middle and high school students in today’s world. With money management and financial skills being essential for adulthood, implementing engaging personal finance projects can make a huge impact on students’ financial literacy. This comprehensive guide will provide an overview of the diverse range of personal finance projects available for educators to implement…

Read More » -

Is Prepaid Insurance an Asset? Detailed Guide 2023

Prepaid insurance is a common concept for businesses and individuals looking to secure coverage in advance. But an intriguing question arises – can prepaid insurance be classified as an asset on the balance sheet? This blog post will explore the definition and accounting treatment of prepaid insurance and analyze how it can be considered an asset based on accounting standards.…

Read More » -

How Long Does the Executor Have to Pay the Beneficiaries

The passing of a loved one is an emotional and challenging time. As an executor, you take on the great responsibility of managing the estate settlement and ensuring beneficiaries receive the inheritance they are entitled to. But before you can distribute assets to heirs, a detailed legal process must run its course. Probate procedures establish protections for all parties, but also…

Read More » -

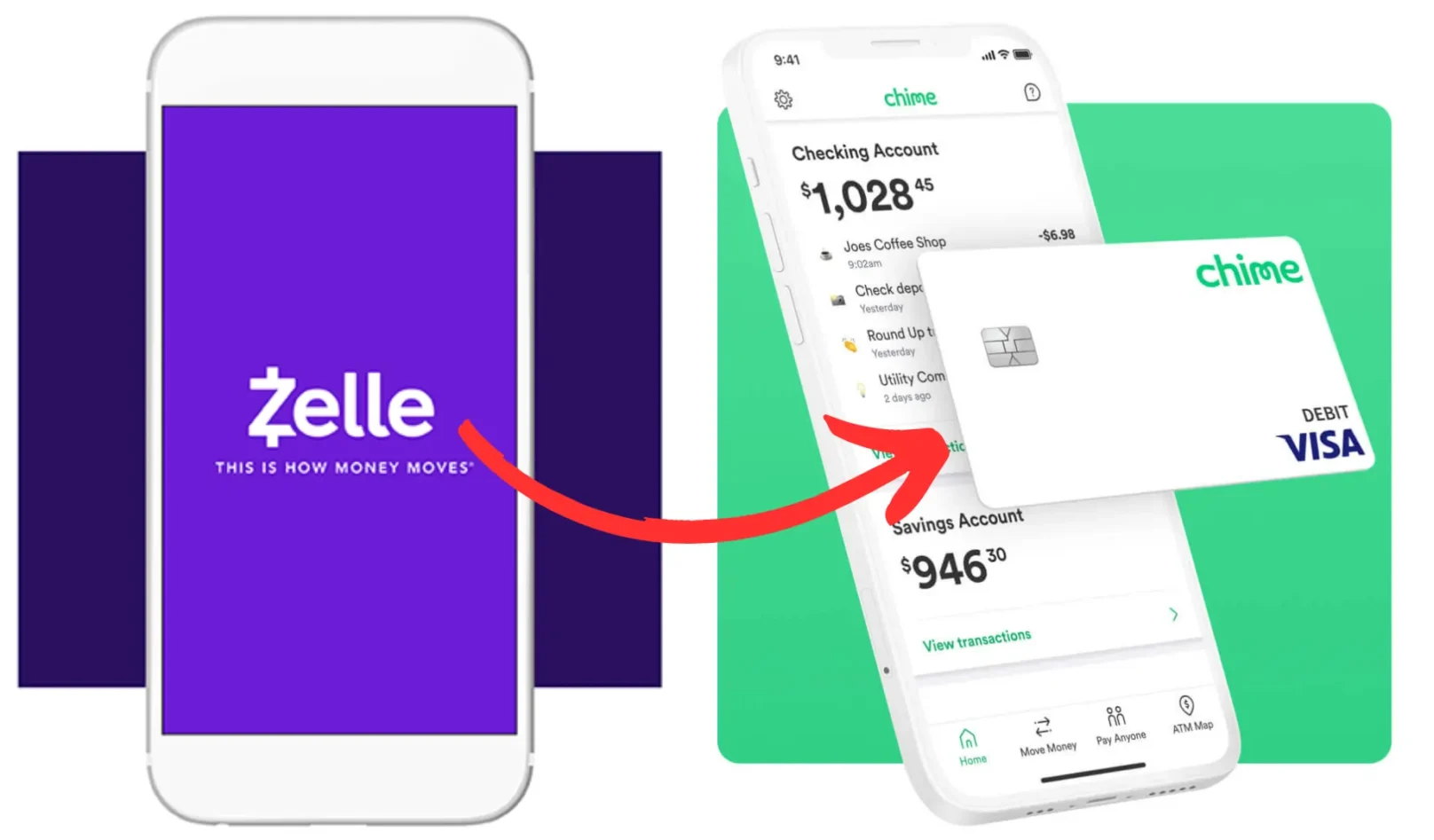

Can I Transfer Zelle to Chime?

If you use the popular money transfer app Zelle and want to send funds to someone with a Chime bank account, you may be wondering – can I transfer Zelle to Chime? The short answer is yes, you can send money from your Zelle app to a Chime debit card. However, there are a few steps involved since Zelle and…

Read More » -

Online Jobs for Teens: List for Easy Part Time Jobs

Introduction In today’s digital era, the internet provides an exciting new avenue for teens to start earning their own money through online jobs. While the traditional job market can be difficult for teens due to age restrictions or limited flexibility with school schedules, the online marketplace offers a wealth of opportunities to earn income. From blogging to tutoring online, teens…

Read More » -

Ways to Save Money in Everyday Life

It might seem simple that saving is just another task on your to-do list which will be marked with no such effort, but it’s not. You need to fully devote yourself for the sake of your survival by eliminating the urges that have a negative impact on your spending habits. By being mindful of this concern and staying on a…

Read More » -

The Key Differences Between Fixed and Flexible Budgets

For any business, organization, or even personal household, budgeting is a critical component of financial planning and management. Appropriate budgeting establishes predefined limits on spending, helps make financially sound decisions, and aids in evaluating performance. There are two main types of budgets that entities can utilize – fixed budgets and flexible budgets. Each budget type has its own advantages and…

Read More » -

Travel on a Budget: Money-Saving Tips and Tricks

Traveling the world is one of life’s greatest joys. However, between flights, accommodations, food, and activities, travel costs can quickly add up. With some planning and research, you can have the trip of your dreams without going broke. This comprehensive guide shares insider tips to travel on a budget and how to stretch your vacation dollars. Understand All the Costs…

Read More » -

Outsmarting Financial Fraudsters: A Guide to Avoiding Scams

Scam artists have adapted to the digital age with cunning new schemes targeting the unsuspecting public. With technology expanding access and anonymity, everyone is vulnerable if not careful. This article will illuminate today’s most brazen frauds and provide tactics to keep your money secure. Financial crimes may seem modern, but roots stretch back centuries. Deceptive snake oil salesmen, phony treasure…

Read More » -

Guide to Establishing an Emergency Fund

Life is full of surprises – some fun, others not so much. From a sudden medical expense to a car breakdown or even losing a job, unexpected crises happen more often than we’d like. And they can wreak havoc on our finances if we’re not prepared. Having an emergency fund can make all the difference in surviving life’s uncertainties without…

Read More »